Integrating Environmental, Social, and Governance (ESG) principles into supply chain management is increasingly recognized as a strategic approach to mitigate risks and gain a competitive edge. By proactively addressing ESG factors, companies can enhance resilience, meet stakeholder expectations, and drive long-term profitability.

Understanding ESG Risks in the Supply Chain

Supply chains are susceptible to various ESG-related risks that can significantly impact business operations:

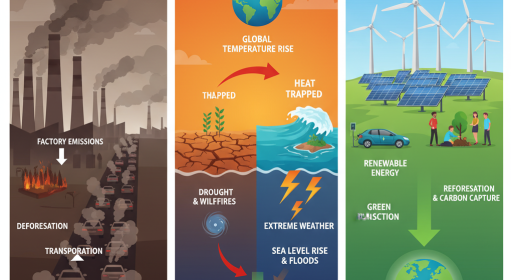

- Environmental Risks: Issues such as resource depletion, pollution, and non-compliance with environmental regulations can disrupt supply chains and lead to legal and reputational consequences.

- Social Risks: Concerns related to labor practices, human rights violations, and inadequate working conditions among suppliers can result in public backlash and loss of customer trust.

- Governance Risks: Lack of transparency, unethical business practices, and weak compliance mechanisms can expose companies to fraud and corruption.

Addressing these risks is crucial, as they can lead to operational disruptions, financial losses, and damage to brand reputation.

Turning ESG Risks into Competitive Advantages

By effectively managing ESG risks, companies can transform potential vulnerabilities into strengths:

- Enhanced Brand Reputation: Demonstrating a commitment to sustainable and ethical practices can strengthen brand loyalty and attract environmentally and socially conscious consumers.

- Operational Efficiency: Implementing sustainable practices, such as optimizing resource use and reducing waste, can lead to cost savings and improved efficiency.

- Regulatory Compliance and Risk Mitigation: Proactively addressing ESG issues helps ensure compliance with evolving regulations, reducing the risk of legal penalties and supply chain disruptions.

- Access to Capital: Investors are increasingly considering ESG performance in their decisions. Companies with strong ESG credentials may benefit from better financing opportunities.

- Supply Chain Resilience: Collaborating with suppliers to uphold ESG standards can enhance the overall resilience and reliability of the supply chain.

Strategies for Integrating ESG into Supply Chain Management

To effectively incorporate ESG principles, companies can adopt the following strategies:

- Conduct Comprehensive ESG Risk Assessments: Regularly evaluate suppliers for ESG compliance to identify and address potential risks.

- Develop Clear ESG Policies and Standards: Establish and communicate ESG expectations to suppliers, ensuring alignment with the company’s values and regulatory requirements.

- Engage in Supplier Collaboration and Training: Work closely with suppliers to promote sustainable practices and provide training to improve ESG performance.

- Implement Monitoring and Reporting Systems: Utilize technology to track ESG metrics and ensure transparency in reporting, facilitating continuous improvement.

- Stay Informed on Regulatory Changes: Keep abreast of evolving ESG-related regulations to maintain compliance and adapt strategies accordingly.

By embedding ESG considerations into supply chain management, companies not only mitigate risks but also position themselves as leaders in sustainability, gaining a competitive advantage in the marketplace.